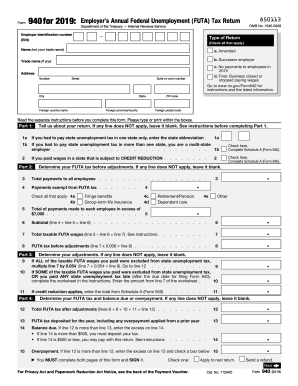

CA DE 9 2014-2024 free printable template

Show details

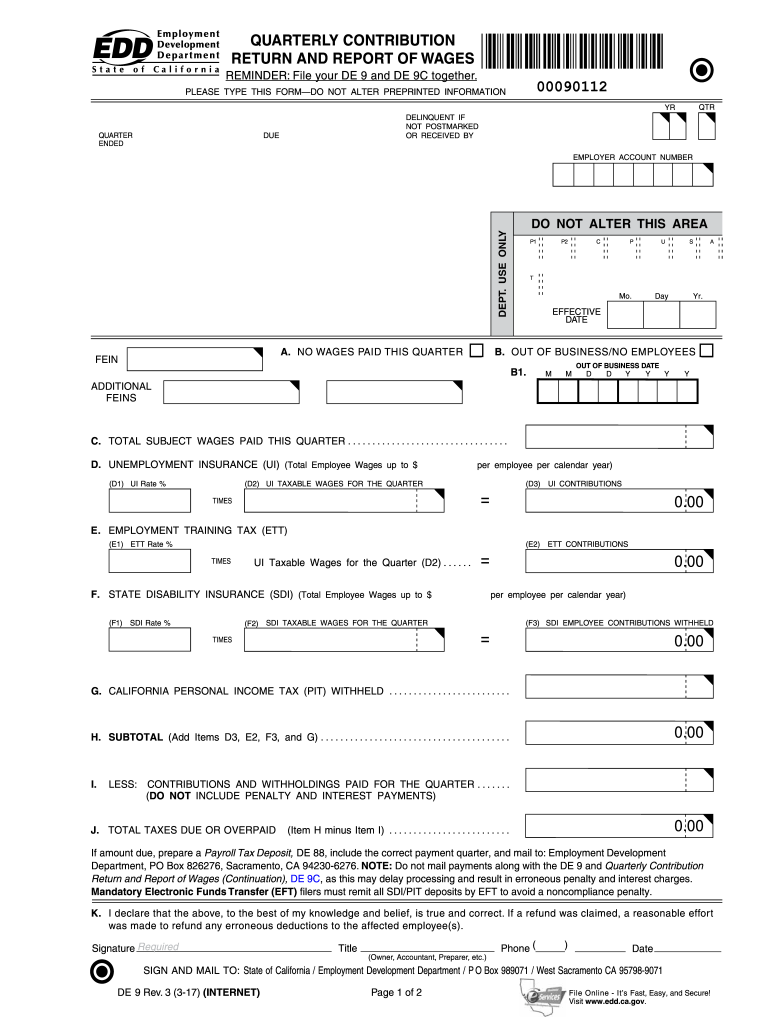

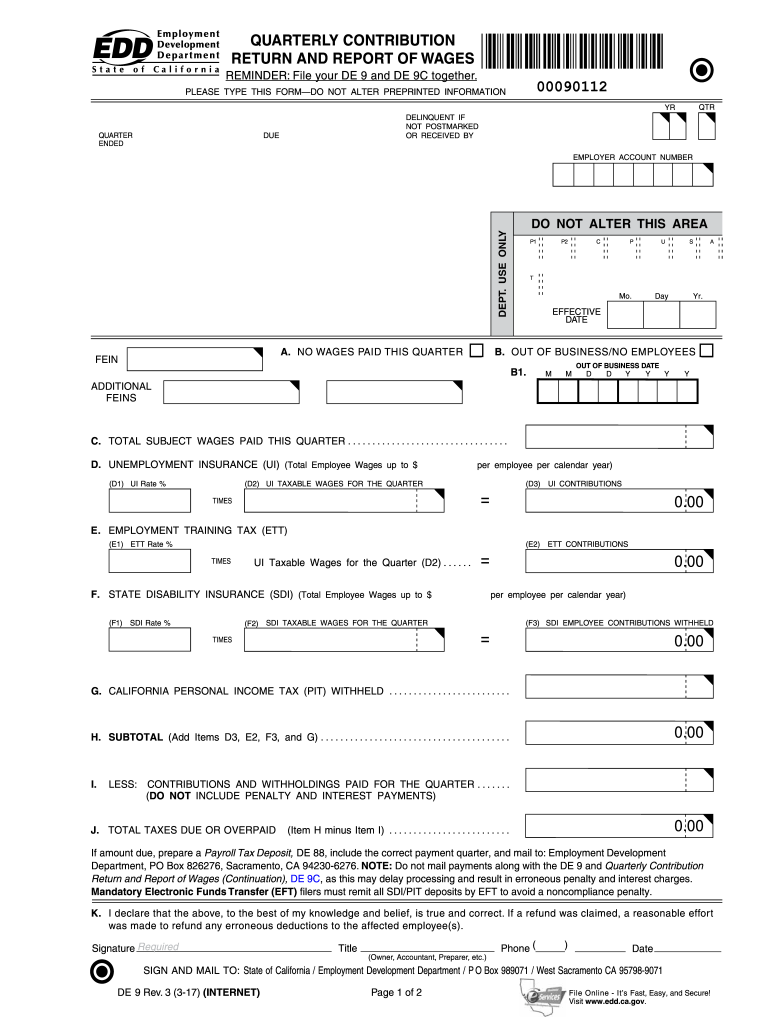

ITEM B1. Enter the OB/NE date where indicated and complete Line K. NOTE If you closed the business this quarter you must file the DE 9 and DE 9C within ten days of closing the business to avoid any penalties. O. Box 826276 Sacramento CA 94230-6276. NOTE Do not mail payments along with the DE 9 and Quarterly Contribution Return and Report of Wages Continuation DE 9C as this may delay processing and result in erroneous penalty and interest charges. NOTE Mailing payments with the DE 9 form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your de9 2014-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de9 2014-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing de9 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit de9 form 2023. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

CA DE 9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out de9 2014-2024 form

Instructions on how to fill out DE9 and the individuals or entities who require DE9 are as follows:

How to fill out DE9:

01

Gather all the necessary information, such as employer and employee details, wages, and tax withholdings.

02

Complete Section 1 of the DE9 form by providing the employer's information, including name, address, and employer identification number (EIN).

03

Fill out Section 2 of the DE9 form with details of each employee, including their name, social security number, and wages earned during the reporting period.

04

Calculate the total wages paid and tax withholdings for each employee and input them in the designated fields.

05

Report any adjustments, corrections, or other relevant information in Section 3 of the DE9 form.

06

Review the completed form for accuracy and completeness before submitting it to the appropriate tax authorities.

Who needs DE9:

01

Employers in California who have employees must fill out DE9. This includes businesses of all sizes and types, such as corporations, partnerships, sole proprietors, and nonprofits.

02

Individuals who employ household workers, such as nannies or caretakers, are also required to complete DE9.

03

Any entity that provides services to California residents and pays wages to employees within the state is obligated to file DE9.

Remember to consult the California Employment Development Department (EDD) or a tax professional for further guidance and clarification specific to your situation.

Video instructions and help with filling out and completing de9

Instructions and Help about ca de 9 form

Fill de9 form sample : Try Risk Free

People Also Ask about de9

What is DE9C vs DE9?

What is a de 9 form?

What is a de 9C form for payroll?

What is a DE9 form?

Where do I find a DE9 form?

Is form 941 same as DE9C?

What is DE9?

What is a de 9 and DE9C?

What does DE9 stand for?

What is de 9 for payroll?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file de9?

Employers are required to file Form DE 9, the California Employer's Quarterly Contribution Return and Report of Wages, with the Employment Development Department (EDD).

How to fill out de9?

1. Enter the name of the taxpayer in the “Name” section.

2. Enter the address of the taxpayer in the “Address” section.

3. Enter the taxpayer’s Social Security number in the “Social Security Number” section.

4. Enter the filing status in the “Filing Status” section.

5. Enter the total income for the tax year in the “Income” section.

6. Enter any deductions in the “Deductions” section.

7. Enter any credits in the “Credits” section.

8. Enter any tax already paid in the “Tax Paid” section.

9. Enter the amount of tax that is still owed in the “Tax Due” section.

When is the deadline to file de9 in 2023?

The deadline to file Form DE-9 in 2023 is April 30, 2023.

What is de9?

DE9, also known as Distinctive Eclectic 9, is a musical compilation series created by Richie Hawtin. It consists of nine mixes which explore different styles of minimal techno music. Each mix is a continuous DJ set that showcases Hawtin's unique approach to blending and layering tracks, creating a distinctive and dynamic listening experience. The DE9 series has been highly influential in the electronic music scene and has received critical acclaim for its innovative use of technology and seamless mixing techniques.

What is the purpose of de9?

DE9 is a code that refers to the "Dimensional Modeler's Manifesto," which consists of a set of guidelines and principles for designing and implementing data warehouses and business intelligence systems. The purpose of DE9 is to provide best practices and recommendations to ensure that data models are efficient, scalable, and adaptable for decision support purposes. It aims to promote simplicity, flexibility, and maintainability in data warehouse development while aligning with business requirements and data modeling concepts. Ultimately, the purpose of DE9 is to improve the overall quality of data warehouse implementations and enable effective analysis and decision-making for organizations.

What information must be reported on de9?

The DE9 form, also known as the Quarterly Contribution Return and Report of Wages, is a report that employers in the state of California must submit to the Employment Development Department (EDD). The DE9 form includes the following information:

1. Employer and Employee Information: It requires the employer's business name, address, and identification number, along with employee information like name, social security number, and wages paid.

2. Taxable Wages: This section requires reporting of taxable wages paid to employees during the quarter, including regular wages, bonuses, commissions, and other forms of compensation subject to California state employment taxes.

3. Employee Tax Withholdings: Employers need to report the amounts of state income tax, disability insurance, and personal income tax withheld from each employee's wages.

4. Employer Contributions: This section includes the employer's contributions towards state disability insurance, unemployment insurance, and employment training taxes for each employee.

5. Quarterly Totals and Payments: Employers must summarize the total wages paid, total employee withholdings, and total employer contributions for the quarter. They also need to provide details of any payments made towards these taxes during the quarter.

Overall, the DE9 form provides the EDD with a summary of wages paid, tax withholdings, and employer contributions for each quarter, enabling them to calculate and reconcile the employment taxes owed by the employer.

What is the penalty for the late filing of de9?

The DE9 is a report that employers in California are required to file with the Employment Development Department (EDD) to report quarterly wages and taxes. Failure to file the DE9 by the designated deadline can result in penalties.

As of my knowledge in October 2021, the penalty for late filing of the DE9 can vary depending on the number of employees you have and the extent of the delay. Here is a general overview:

1. Late filing penalty: If you fail to file the DE9 by the prescribed due date, you may be subject to a late filing penalty of $50 for each month or portion of a month until the report is filed. The maximum penalty amount is $500 per quarter.

2. Inaccurate filing penalty: Apart from late filing penalties, if the DE9 is filed inaccurately or contains errors, there can be additional penalties. The exact penalty amount would depend on the severity of the errors and whether they were intentional or unintentional.

It is important to note that penalties can change over time, and it is always advisable to refer to the most current guidelines provided by the EDD or consult with a professional for accurate and up-to-date information regarding penalties for late filing of the DE9.

How can I get de9?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific de9 form 2023 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in de 9 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your de9 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the de 9 form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign form de 9 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your de9 2014-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

De 9 is not the form you're looking for?Search for another form here.

Keywords relevant to ca de9 form

Related to de 9 california printable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.